Nov 10, 2020|Market Insights- 13 min

Overview

1. Resurgence of COVID-19 cases in Europe

2. Central bank officials call for fiscal stimulus

3. US presidential election approaches

4. China grows while the world slows

5. Earnings beat estimates but fail to appease markets

6. US equities have worst month since March

7. Sentiment turns fearful on election and second wave

Policy & Geopolitics

Further stimulus must wait for the election

In September, the Federal Reserve (the “Fed”) held its first meeting since officials announced a new policy framework in August which would stop raising interest rates preemptively and allow inflation to rise modestly above its 2% target.

The minutes of the September meeting released earlier this month showed that economic forecasts have improved since June, with expectations of GDP contracting 3.7% in 2020 (June forecast was 6.5%), year end unemployment at 7.6% (9.3% in the June forecast); Core Personal Consumption Expenditure inflation of 1.5% (1.0% in the June forecast), and an otherwise unchanged policy path. The monthly purchase of US$120 billion in treasury and mortgage bonds is not expected to change at the next meeting in November. Fed Chairman Jerome Powell expressed concern over the rising COVID-19 infections and reiterated calls for more fiscal stimulus to support the US economy. Powell dismissed concerns over rising fiscal deficits, stressing that the risk of too little stimulus outweighs the risk of too much, and that excess fiscal stimulus “will not go to waste.”

After months of debate, White House officials and House Speaker Nancy Pelosi are approaching agreement on a nearly US$2 trillion COVID relief package. Senate Republicans voiced concerns about the record budget deficit, which tripled to US$3.1 trillion, and proposed US$500 billion in aid. An agreement before the November 3 presidential election is unlikely, which could delay the stimulus for several months. Fed officials fear such a delay could repeat the slow rebound from the 2008 financial crisis.

As COVID-19 cases surge, lockdowns and restrictions are being re-imposed across Europe, threatening the economic recovery from the first wave. Although the European Central Bank (the “ECB”) has made no further policy changes, ECB President Christine Lagarde said at a news conference on October 29 that another stimulus package may be unveiled in December.

China’s transforming economy gives it global leverage

The strained relations between the US and China have deteriorated further. The war over trade and technology continued as China added a new export restriction to protect national security, which could target exports to the U.S. China’s Q3 2020 GDP expanded 4.9% year on year (YoY), proving the potency of its gradual shift towards a domestic and service-oriented economy. The International Monetary Fund projects China’s economy to expand 1.9% in 2020, the only major economy to grow this year amidst the pandemic.

US presidential election

As the 2020 Presidential race approaches, more than 65.5 million votes have already been cast around the U.S. and polls indicate a substantial lead by Joe Biden over President Donald Trump nationwide. The candidates have opposing views on key policy issues including taxes, health care, global trade, Big Tech, China, and dealing with COVID-19 and the economic downturn.

• September 29: President Trump and Joe Biden held thefirst Presidential debate in Cleveland, Ohio, discussing COVID-19, the economy, the Supreme Court, racial injustice, etc.

• October 2: President Donald Trump and First LadyMelania Trump tested positive for COVID-19. President Trump was admitted to Walter Reed National Military

Medical Center a day later.

• October 7: Vice President Mike Pence and SenatorKamala Harris held the Vice-Presidential debate in Salt Lake City, Utah.

• October 8: The Commission of Presidential Debates announced that the second presidential debate on October 15 will be held virtually, due to Trump’s positive COVID diagnosis. Trump said he will not participate.

Biden agreed to postpone the debate.

• October 22: The final presidential debate was held atBelmont University in Nashville, Tennessee.

• October 27: Associate Justice Amy Coney Barret beganher tenure as the 115th justice on the US Supreme Court, establishing a broad conservative majority for the first time in over 70 years.

Macro Indicators

Unemployment continues to fall in the US and rise in Europe

The US labor market continued to recover in September as unemployment dropped to 7.9% from 8.4% in August, the lowest since COVID-19 shutdowns began and well below the 14.7% peak in April. Non-farm payroll rose by 661,000 in September, driven largely by the re-hiring of furloughed workers. Weekly initial claims for unemployment benefits fell by 40,000 from the previous week to a seasonally adjusted 751,000 in the week ending October 24, the lowest level since the pandemic started. Eurozone unemployment increased to 8.3% in September 2020 from 8.1% in August 2020.

Global economic activity rebounds but faces second wave Annualized U.S. GDP grew 33.1% in Q3 2020, the fastest pace in more than a year and a half, beating the Dow Jones estimate of 32.0%, following a 31.7% annualized drop in Q2 GDP, the largest since 1947. The rebound was largely due to increased consumer activity and a rise in business and real estate investment and exports. Retail sales increased 1.9% in September, marking five consecutive months of growth. Eurozone GDP surged a record 61.3% annualized in Q3, well exceeding economists’ forecasts of 44.3%, with double-digit growth in major economies such as France, Italy and Spain. However, the rebound is poised to falter as new restrictions come into place.

Existing home sales in the US rose 9.4% in September to a seasonally adjusted annual rate of 6.54 million, marking the fourth consecutive month of growth and the highest rate in 14 years. The increase in demand for housing comes against a backdrop of record-low interest rates. The median existing home price increased 14.8% YoY to a record $311,800.

The Core Consumer Price Index (CPI) in the US rose by 0.2% in September from 0.4% in August as businesses continued to reopen and used car sales had the highest increase in 51 years. CPI in the eurozone continued to decline to 0.2% in September from 0.4% in August

The IHS Markit US Manufacturing Purchasing Managers’ Index (“PMI”) rose to 55.5 in October from 54.3 in September, the highest level in over a year and a half. The service index increased from 54.6 to 56.0 while the manufacturing index rose slightly from 53.2 in September to 53.3 in October. The composite PMI for the euro area fell to 49.4 in October from 50.4 in September. The manufacturing index, which rose to 54.4 in October from 53.7 in September amid rising global demand, offset by a decline in the service sector PMI, which fell to 49.4 in October from 50.4 in September due to COVID-19 restrictions.

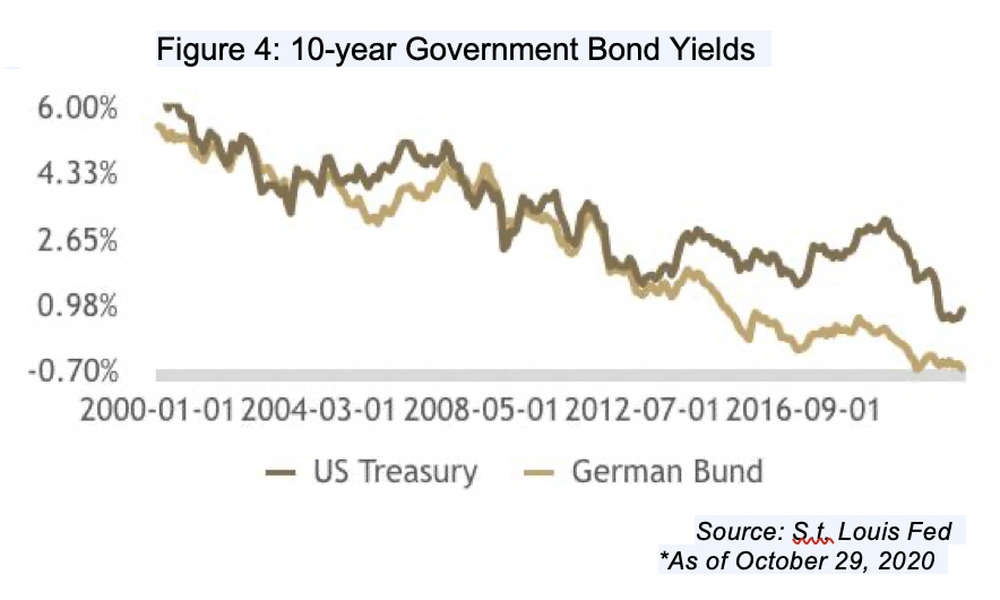

Sovereign bond prices remain high

10-year US Treasury yields increased about 0.18% in October closing at about 0.86% as investors rotated into riskier assets in search of yield. 10-year inflation expectations, measured by Treasury Inflation Protected Securities (“TIPS”), hovered at 1.70%, below the Fed’s target and plunging real yields to its lowest negative territory on record. Germany’s 10-year bund yields fell deeper into negative territory this month to -0.63% as the second in wave in Europe led to scheduled lockdowns starting November. France followed shortly thereafter. The European bond market is watching for another relief policy to accommodate the second round of lockdowns.

Financial Markets

Second wave fears afflict equity markets

The U.S. equity rally faltered in October as major indices recorded their third consecutive monthly decline, a drastic reversal from the 6.0% average monthly returns between April and August. The S&P 500 declined 3.0%, mostly in the last week of the month, the worst since March, coinciding with a COVID-19 spike a week before the elections. The tech-heavy Nasdaq Composite dropped 4.5%, despite a strong earnings season with high expectations.

Following the drop in the S&P 500, last-12-months (LTM) price-to-earnings (P/Es) dropped from 27 times in September to 25 times in October, but remained above the historical 95th percentile in terms of US market capitalization to GDP, LTM P/E, and enterprise value to sales. The Shiller P/E (which uses an inflation-adjusted 10-year average earnings denominator) dropped from 29 to 28 times (just below the 90th percentile), the second highest valuation since 1880 and just surpassing 1929, yet well below the 43 times at the peak of the dotcom bubble. While equities appear overvalued based on conventional valuation metrics, they are undervalued when adjusted for interest rates. As global bond yields approach historical lows, the yields on equities look increasingly attractive, particularly for long-term bond investors accustomed to a duration premium that has diminished with flattening yield curves.

Most major global equity indices also wavered following a second wave of COVID-19, particularly in Europe where new restrictions were announced. The October declines in Europe were more pronounced as it reemerged as the epicenter of the pandemic. The STOXX Europe 600 dropped 6.1%, while the UK FTSE100 fell 4.7%, their worst months since March. Meanwhile, performance in Asia was mixed as Hong Kong’s Hang Seng index returned 3.0%, while the Chinese SSE Composite Index dropped 0.7%.

Ant Group, the Alibaba-affiliated fintech company will raise $34.5 billion in the largest IPO in history, topping the $29.0 billion raised by Saudi Aramco. The shares will trade in Hong Kong and Shanghai, continuing the trend of high-profile Asian IPOs choosing to list domestically instead of the US. Finally, the Japanese Nikkei 225 Index, finished the month down 1.6%.

Credit spreads continue tightening

Investment grade (IG) spreads tightened to 1.33% from 1.44% this month while high-yield (HY) spreads continued to tighten to 5.25% from 5.36% after peaking at 10.87% in March. First-lien spreads to maturity contracted to LIBOR

+ 4.40% from LIBOR + 4.64% while second-lien spreads contracted to LIBOR + 8.60% from LIBOR + 8.78%. The yield-to-maturity of first- and second-lien debt are below year end 2019 levels due to near-zero interest rates and unprecedented Fed support for the fixed income market.

Oil remains in bear market

Spot WTI and Brent crude oil prices fell 8.9% and 11.1%, respectively, to $35.71 and $37.44 per barrel at the end of October, marking the largest monthly drop since March after the first COVID-19 surge and lockdown. Oil prices fell as the US and Europe reported record daily coronavirus cases, Europe imposed new lockdowns, a decreased likelihood of a quick US stimulus package and higher oil output from Libya.

Gold retreats from highs

Driven by rising real interest rates, gold prices dropped 2.3% to $1,880 per ounce for the month, but remained among the best performing assets in 2020.

Earnings

Technology delivers strong earnings

The resilient earnings of mega-cap tech companies against COVID-19 underscored the growth in digitalization, automation, logistics and payments. Big tech names outperformed across the board although their stocks declined due to high investor expectations, the US elections and a second wave of COVID-19.

Apple Q3 2020 revenues of $64.7 billion increased 1% YoY, 2% above estimates, while earnings per share (EPS) of $0.73 were 4% above estimates. Soft sales in iPhones were offset by strong increases in segments such as services, Mac and iPad. Despite the underperformance in iPhone sales, CEO Tim Cook was optimistic about the roll-out of the iPhone 12 with 5G capabilities.

Amazon exceeded expectations as COVID-19 continued to accelerate online commerce. Q3 sales increased a whopping 37% YoY to $96.2 billion, 4% above estimates, while EPS of $12.37 were well above estimates of $7.41. Amazon is expected to deliver even stronger Q4 sales, especially with Prime Day, which offers exclusive savings to Amazon Prime members as the holiday season approaches.

Facebook beat estimates despite pressures from the approaching elections. Sales grew 22% YoY to $21.5 billion, beating estimates of $19.8 billion, while EPS of $2.71 were above the consensus estimates of $1.91. Facebook users and engagement in North America declined as lockdown restrictions were lifted during Q3, but Q4 revenues should benefit from the holiday season.

Alphabet revenues of $46.2 billion were 8% above the consensus estimates, and EPS of $16.40 were above the expectations of $11.29, with double-digit growth across all segments, most notably YouTube revenues that were 32% higher YoY. Digital ad revenue resumed growth trajectory after a dip in July for the first time.

Microsoft revenues of $37.2 billion and EPS of $1.82 topped expectations by 4% and 18%, respectively. Commercial PC sales dropped 22%, but cloud revenues surged 48%. Productivity and Business Processes, which includes Office products and LinkedIn, grew 11%, while Personal Computing, which includes search ads, Surface and Xbox grew 6% YoY. The release of Xbox Series X and Series S in November should improve growth for gaming segment to the high 20% range compared to 22% for the quarter.

Financials mixed but less cautious

Q3 2020 EPS of JPMorgan Chase and Citigroup beat consensus estimates by 31% and 54%, respectively, as their trading divisions outperformed again amidst difficult lending conditions. The earnings of Wells Fargo and Bank of America were less impressive, with the former missing EPS estimates and the latter only narrowly beating them. Both banks are struggling with low interest rates, as net interest income dropped 19% and 17% YoY for Wells Fargo and Bank of America, respectively. Wells Fargo continues to pay for the 2016 fake account scandal, spending US$916 million in Q3 2020 on customer remediation.

The EPS of Morgan Stanley and Goldman Sachs exceeded estimates by 30% and 74%, respectively, as their trading and market-making operations continued to drive strong performance. Morgan Stanley reported record EPS in Q3 2020, beating estimates by 14% across all divisions, including wealth management, investment management, equities trading, and fixed income trading.

JPMorgan Q3 2020 EPS resumed growth at 9% YoY as loan loss provisions dropped to US$611 million from a record $10.5 billion in Q2. Although Bank of America, Citigroup, and Wells Fargo also reported smaller loss provisions in Q3, their Q3 profits declined 16%, 34%, and 56% YoY, respectively. Visa, Mastercard, and American Express all recorded double-digit declines in profit YoY as spending on entertainment and international travel remained depressed. Cross-border activity seems unlikely to improve any time soon given signs of a second wave throughout Europe.

Energy and Industrials remain challenged

Q3 2020 earnings of large energy companies such as Exxon and Chevron were amongst the worst ever in their long histories as COVID continued to take a heavy toll on energy markets. However, both companies maintained their dividend payouts, announcing that their large quarterly losses were mitigated by aggressive cost cuts and some rebound in demand. Consolidation in the sector continued this month as ConocoPhillips agreed to buy Concho Resources for US$9.7 billion and Pioneer Natural Resources agreed to buy Parsley Energy for US$4.5 billion.

Caterpillar revenues and earnings declined 23% and 54%, respectively. As a barometer for construction activity, their earnings show weak global economic demand.

Sentiment

Neutral sentiment despite market rally

The Consumer Sentiment Index of the University of Michigan increased to a seven-month high of 81.8 in October from 80.4 in September, although it remains well below pre-pandemic levels.

The VIX spiked to as high as 40.18 in October, its highest level since mid-June, as investors worry about a second wave of coronavirus in the US and Europe, fiscal stimulus and the US presidential election.

The month-end Fear and Greed Index (which uses seven factors including market momentum, safe-haven demand, and junk bond demand) showed “extreme fear” in safe-haven demand and market volatility. During the last 20 trading days of the month, bond performance exceeded stocks by 2.01%, showing a movement towards safer investments.

COVID-19

Daily COVID-19 cases in the U.S. dropped to their lowest number in two months, but resumed towards month end. On October 23, the U.S. recorded 83,757 new cases, exceeding the previous one-day record of 77,362 in July. States and cities are resorting to stricter measures to contain the virus. Newark, the largest city in New Jersey, has enforced an 8 PM curfew for all businesses except grocery stores, pharmacies and gas stations. El Paso, Texas announced a two-week stay-at-home order and a curfew from 10 PM to 5 AM. Chicago will stop indoor dining. More than 230,000 deaths have been reported amid nearly 8.9 million confirmed coronavirus cases in the US. Globally, more than 1.2 million deaths have been reported amid nearly 45.1 million confirmed cases.

Cases are rising sharply across Europe, with several countries surpassing their daily record. France and Germany, the biggest eurozone economies, are reinforcing national lockdowns. French President Emmanuel Macron has announced a nationwide lockdown until at least December 1. The new measures mean that people can only leave their houses to buy essential goods or seek medical attention. Cafes, restaurant and shops will close in France and Germany, except essential ones such as supermarkets and pharmacies. People need a written statement justifying their presence outside their homes. India and Brazil continue to have the highest cumulative confirmed cases after the U.S.

The Month Ahead

1. US Presidential elections approaching. Former Vice President Biden leads in the polls over President Trump. The final debate occurred on October 22. Election results are not expected to be released immediately after election day on November 3.

2. Second wave of COVID-19. As COVID-19 cases surge again across the globe, more countries and cities are either starting or planning a second round of restrictions and lockdowns, which threaten economic recovery and compound the economic damage of the Spring lockdowns.

3. More vaccine news. As of late September, Johnson & Johnson, Astrazeneca, Merck, Sharpe & Dohme, Moderna and Pfizer were in the final stages of trials for a COVID-19 vaccine, but Dr. Anthony Fauci, Director of the National Institute of Allergy and Infectious Diseases, said that a vaccine is unlikely to be available before January.

Disclaimer

This presentation is provided to you by The Family Office Co. BSC(c) (“The Family Office”) for informational purposes only, and contains proprietary information that may not be reproduced, distributed to, or used by, any third parties without The Family Office’s prior written consent.

All information, figures, calculations, graphs and other numerical representations appearing in this presentation have not been audited and may be subject to change over time. Furthermore, certain valuations (including valuations of investments) appearing in this presentation are subject to change as they may be based on either estimates or historical figures that do not reflect the latest valuation. Although all information and opinions expressed in this presentation were obtained from sources believed to be reliable and in good faith, no representation or warranty, express or implied, is made as to their accuracy or completeness. The information contained herein is not a substitute for a thorough due diligence investigation. Past performance is not indicative of and does not guarantee future performance. Exit timelines, prices and related projections are estimates only, and exits could happen sooner or later than expected, or at a higher or lower valuation than expected, and are conditional, among other things, on certain assumptions and future performance relating to the financial and operational health of each business and macroeconomic conditions.

The Family Office makes no representation or warranty, express or implied, with respect to any statistics or historical or current financial data, whether created by The Family Office through its own research or quoted from other sources. With respect to any such statistics or data delivered or made available by or on behalf of The Family Office, it is acknowledged that (a) the investor takes full responsibility for making its own evaluation of the materiality of the information and the integrity of the quoted source and (b) the investor has no claim against The Family Office.

Amounts in currencies other than the US Dollar are translated using prevailing market rates as calculated by The Family Office or its service providers and may differ from the rates used by banks. The rates are indicative only and do not reflect the rates at which The Family Office would be prepared to enter into any transactions with other parties.

Certain information contained in this presentation constitutes “forward looking statements,” which can be identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “plans,” “estimates,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. To the extent this presentation contains any forecasts, projections, goals, plans and other forward looking statements, such forward looking statements are inherently subject to, known and unknown, significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond The Family Office’s control and may cause actual performance, financial results and other projections in the future to differ materially from any projections of future performance, results or achievements expressed or implied by such forward looking statements. Investors should not place undue reliance on these forward looking statements. The Family Office undertakes no obligation to update any forward looking statements to conform to actual results or changes in The Family Office’s expectations, unless required by applicable law.

The Family Office makes no representation or warranty, express or implied, with respect to any financial projection or forecast With respect to any such projection or forecast delivered or made available by or on behalf

of The Family office, it is acknowledged that (a) there are uncertainties inherent in attempting to make such projections and forecasts, (b) the investor is familiar with such uncertainties, (c) the investor takes full responsibility for making its own evaluation of the adequacy and accuracy of all such projections and forecasts so furnished to it and (d) the investor has no claim against The Family Office.

This presentation represents a summary of certain information, the full terms of which are contained in a Private Placement Memorandum that should be reviewed for a more complete understanding of the investments and their risks. In addition, this presentation does not constitute an offer to sell, or a solicitation to buy, any instrument or other financial product, nor does it amount to a commitment by The Family Office to make such an offer at present or an indication of The Family Office’s willingness to make sure an offer in the future.

Instagram

Instagram