Jun 20, 2022|Market Insights- 8 min

Overview

1. The Federal Reserve (the “Fed”) continue rate hikes

2. Geopolitical tensions persist over Ukraine

3. The European Central Bank (ECB) hints at rate hikes in July

4. Euro near parity with the U.S. dollar for the first time in 20 years.

5. Disruptions threaten global economic growth

6. OPEC+ to raise production targets

Policy & Geopolitics

The Fed continue rate hikes

The Fed raised rates by 0.50% during its May 2022 meeting, pushing the federal fund rate to a range of 0.75%-1%. May saw the second consecutive rate hike and the biggest rise in borrowing cost since 2000, with the market pricing rates rising to 2.75%-3% by year-end.

U.S. prices rose 8.3% year-over-year (YoY) in May driven by persistently high energy and food prices. As the burden of inflation on low-income people continues to intensify, multiple 0.50% rate hikes are expected. Fed Chairman Jerome Powell said that only 0.50% hikes would be considered in the next couple of meetings, eliminating previous speculations of a 0.75% increase.

The Fed has also indicated that it will begin reducing its balance sheet by $9 trillion in stages, by not reinvesting maturing bonds. $30 billion in Treasury bonds and $17.5 billion in mortgage-backed securities will be allowed to mature monthly starting June 1, increasing to $60 billion and $35 billion, respectively, three months thereafter.

The ECB is prepared to hike rates for the first time in more than a decade. Long known as one of the world’s most dovish central banks, the ECB is expected to raise rates at least four times by year-end amidst a continued rise in inflation. In March, the ECB ended its net asset purchases, and hinted at the first interest rate hike in July.

In May, the euro was almost at parity with the US dollar for the first time in 20 years, declining steadily against the US dollar from $1.22 in June 2021 to around $1.05 on May 19.

Geopolitical tensions persist over Ukraine

As the conflict in Ukraine continues, the European Union (EU) is implementing new sanctions on Russia.

The EU has stopped importing Russian oil by sea, excluding about two-thirds of total imports. Russian oil will continue to flow temporarily by pipeline, benefitting countries like Hungary and Slovakia that are heavily dependent on it. Germany and Poland, however, declared that they would stop importing Russian oil by pipeline by year end. According to EU President, Ursula von der Leyen, this will reduce EU oil imports from Russia to 10-11% of their current level.

Macro Indicators

Robust job gains despite relentless inflation

In May, U.S. unemployment remained at 3.6% for the third month, with the number of unemployed unchanged at 6.0 million, comparable to pre-pandemic unemployment of 3.5% with 5.7 million unemployed in February 2020. The U.S. economy added 390,000 jobs in May. Notable job gains were in leisure and hospitality, professional and business services, and transportation and warehousing. Employment in retail trade declined. The May labor force participation edged higher to 62.3% but was still 1.1% below pre-pandemic levels.

In April, the euro area unemployment was 6.8%, unchanged from March 2022 and 8.2% below April 2021.

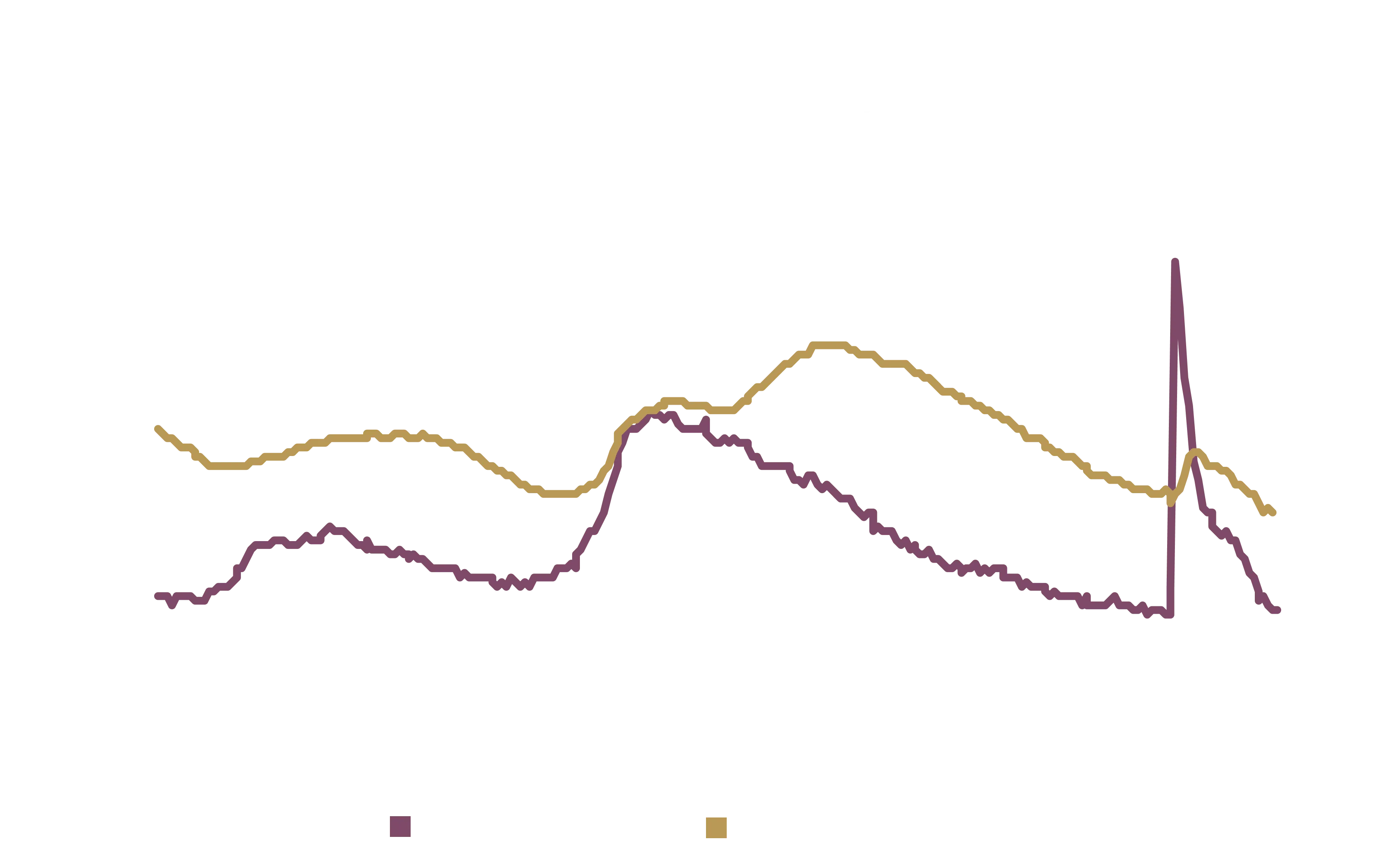

Source: Sources: Federal Reserve Bank of St. Louis, Eurostat

*US as of May 2022; Euro Area as of March 2022

Disruptions threaten global economic growth

IHS Markit expect global real GDP to grow 2.9% in 2022, revised down by 0.3% due to weaker growth prospects in mainland China and the U.S. While global economic expansion is expected to continue at a diminished pace, geopolitical, financial, or supply-side shocks could tip the world economy into recession.

Personal consumption expenditures, the preferred inflation indicator of the Fed, increased 6.3% YoY in April, but was below the 6.6% in March.

U.S. retail sales rose 0.9% in April, marking the fourth straight month of higher retail spending, despite the March reading being revised to 1.4% from 0.5%.

U.S. existing home sales declined 2.4% to a seasonally adjusted annual rate of 5.61 million in April, its slowest since June 2020 and slightly below forecasts of 5.65 million.

The US Consumer Price Index (CPI) rose 8.3% YoY in April, above the 8.1% estimate and near the highest level in more than 40 years. Core CPI, which excludes food and energy, also rose above expectations by 6.2% YoY in April.

Eurozone CPI remained at 7.4% in April, driven mainly by energy and food prices. Annual inflation fell in three EU states, remained stable in two and rose in 22.

The IHS Market Manufacturing Purchasing Managers’ Index (PMI) decreased to 57.0 in May from 59.2 in April in the US and to 54.6 from 55.5 in the Euro area.

Sovereign bond yields rise amid investor concerns

U.S. 10-Year Treasury yields peaked at 3.13% on May 6 as the Fed hiked rates by 0.50%, closing the month at 2.84%. Germany’s 10-year bund yields remained in positive territory, closing May at 1.12% due to relentless inflation.

Source: Bloomberg

*As of May 31, 2022

Financial Markets

Equity markets remain impacted by hawkish policy shift

The S&P 500 and Dow Jones rose 0.01% and 0.04%, respectively, in May. Nasdaq composite fell 2.06% in May as the Fed raised rates by 0.5% at the beginning of the month.

The STOXX Europe 600 fell 1.56% in May, while the UK FTSE 100 rose 0.84%. The Chinese SSE Composite Index and the Japanese Nikkei 225 Index rose 4.57% and 1.61%, respectively, while the Hong Kong Hang Seng index rose 1.54%.

Credit spreads widen

Investment grade spreads decreased slightly to 1.40% at the end of May from 1.41% in April in step with weak equity markets and rate hikes, while high-yield spreads rose to 4.22% in May from 3.97% in April.

Oil prices reach new highs amid geopolitical tensions

Spot WTI and Brent crude oil prices rose from $104.69 and $109.34 per barrel, respectively, in April to $114.67 and $122.84 at the end of May. On May 10, WTI and Brent had dropped to their lowest level for the month at $99.76 and $102.46, respectively, as the demand outlook was pressured by coronavirus lockdowns in China and growing recession risks.

OPEC+ decided to raise its daily production targets by 432,000 barrels for June, gradually unwinding record supply cuts as planned. OPEC expect 2022 daily world oil demand to expand by 3.67 million barrels, 480,000 barrels below its previous forecast due to Chinese lockdowns curbing the use of transport fuels and petrochemical feedstock.

Energy prices surged in the euro area as the conflict in Ukraine continued. With Russia accounting for 25% of EU oil imports and almost half its gas, concerns mounted as the EU planned new sanctions on Russia. Energy prices in the euro area increased 39% YoY at the end of May.

Source: Bloomberg

* As of May 31, 2022

US dollar and gold falls, and Bitcoin plummets

The US dollar remained above 100, ending at 101.75 on May 31 down from 102.96 at the end of April. Meanwhile, gold prices fell 3.16% from $1,897 at the end of April to $1,837 on May 31. Bitcoin dropped 18% from $38,593,02 at the end of April to $31,713.08 at the end of May.

Sentiment

Consumer sentiment falls amid inflation fears

The Consumer Sentiment Index of the University of Michigan was revised down to 58.4 in May, the lowest since August 2011, from a preliminary reading of 59.1. The May reading was 16% below the 65.2 reading in April.

The VIX index decreased to 26.2 in May from 33.4 in April following the second rate hike by the Fed.

The month-end Fear and Greed Index (which uses seven factors including market momentum, safe-haven demand, and junk bond demand) showed “Fear” at 26 at the end of May as investors flee risky stocks for the safety of bonds.

COVID-19

The number of COVID-19 cases and deaths fell significantly since their January highs.

US daily cases in May were substantially below the January peak of 800,000, with a seven-day average of 91,170 cases at the month end. As hospitalization cases dropped throughout the country, many state leaders opted to ease their mask and proof-of-vaccination requirements.

New infection in Europe have more than halved last month, from just above 180,000 in late April to around 45,000 at the end of May.

In China, Shanghai remained in lockdown as the country committed to a zero-covid policy. The local government is expected to lift the lockdown on June 1, 2022.

Elsewhere in the world, cases surged in May in countries and regions like Singapore, Hong Kong, and New Zealand, which kept their number of COVID-19 cases under control for most of the pandemic.

The Month Ahead

1. China to lift lockdown in Shanghai

2. ECB monetary policy meeting on June 9-10

3. Fed FOMC meeting on June 14-15

Disclaimer

This presentation is provided to you by The Family Office Co. BSC(c) (“The Family Office”) for informational purposes only, and contains proprietary information that may not be reproduced, distributed to, or used by, any third parties without The Family Office’s prior written consent.

All information, figures, calculations, graphs and other numerical representations appearing in this presentation have not been audited and may be subject to change over time. Furthermore, certain valuations (including valuations of investments) appearing in this presentation are subject to change as they may be based on either estimates or historical figures that do not reflect the latest valuation. Although all information and opinions expressed in this presentation were obtained from sources believed to be reliable and in good faith, no representation or warranty, express or implied, is made as to their accuracy or completeness. The information contained herein is not a substitute for a thorough due diligence investigation. Past performance is not indicative of and does not guarantee future performance. Exit timelines, prices and related projections are estimates only, and exits could happen sooner or later than expected, or at a higher or lower valuation than expected, and are conditional, among other things, on certain assumptions and future performance relating to the financial and operational health of each business and macroeconomic conditions.

The Family Office makes no representation or warranty, express or implied, with respect to any statistics or historical or current financial data, whether created by The Family Office through its own research or quoted from other sources. With respect to any such statistics or data delivered or made available by or on behalf of The Family Office, it is acknowledged that (a) the investor takes full responsibility for making its own evaluation of the materiality of the information and the integrity of the quoted source and (b) the investor has no claim against The Family Office.

Amounts in currencies other than the US Dollar are translated using prevailing market rates as calculated by The Family Office or its service providers and may differ from the rates used by banks. The rates are indicative only and do not reflect the rates at which The Family Office would be prepared to enter into any transactions with other parties.

Certain information contained in this presentation constitutes “forward-looking statements,” which can be identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “plans,” “estimates,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. To the extent this presentation contains any forecasts, projections, goals, plans and other forward-looking statements, such forward-looking statements are inherently subject to, known and unknown, significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond The Family Office’s control and may cause actual performance, financial results and other projections in the future to differ materially from any projections of future performance, results or achievements expressed or implied by such forward-looking statements. Investors should not place undue reliance on these forward-looking statements. The Family Office undertakes no obligation to update any forward-looking statements to conform to actual results or changes in The Family Office’s expectations, unless required by applicable law.

The Family Office makes no representation or warranty, express or implied, with respect to any financial projection or forecast. With respect to any such projection or forecast delivered or made available by or on behalf of The Family office, it is acknowledged that (a) there are uncertainties inherent in attempting to make such projections and forecasts, (b) the investor is familiar with such uncertainties, (c) the investor takes full responsibility for making its own evaluation of the adequacy and accuracy of all such projections and forecasts so furnished to it and (d) the investor has no claim against The Family Office.

This presentation represents a summary of certain information, the full terms of which are contained in a Private Placement Memorandum that should be reviewed for a more complete understanding of the investments and their risks. In addition, this presentation does not constitute an offer to sell, or a solicitation to buy, any instrument or other financial product, nor does it amount to a commitment by The Family Office to make such an offer at present or an indication of The Family Office’s willingness to make such an offer in the future.

The Family Office is a Category 1 Investment Firm regulated by the Central Bank of Bahrain C.R.No.53871 dated 21/6/2004. Paid Up Capital: US$ 10,000,000. The Family Office only offers products and services to ‘accredited investors’ as defined by the Central Bank of Bahrain.

Instagram

Instagram