Aug 8, 2021|Market Insights- 9 min

Overview

1. Central banks remain dovish despite inflationary signs

2. President Biden pitches $6 trillion in economic spending

3. Equities continue rise amidst low-rate environment

4. US economic growth outlook remains positive

5. Sentiment continues to improve

6. Vaccination progress continues, but India struggles

Policy & Geopolitics

Central banks keep policy frameworks unchanged

At its April policy meeting, the Federal Reserve (the “Fed”) indicated that tighter monetary policy may be considered if economic activity surges, but it will maintain easy monetary policy until employment and inflation goals are reached, maintaining interest rates in the range of 0.00% to 0.25% and target inflation moderately above 2.0%. Fed Chairman Jerome Powell said that economic recovery remains “uneven and far from complete” and that the economy has yet to show the “substantial further progress” required to change policy, notwithstanding a rise in near-term inflation and a drop in jobless claims to a pandemic low.

On May 21, President Biden made an offer to Senate Republicans, cutting down his original $2.3 trillion infrastructure plan to $1.7 trillion, as he continues to urge spending at least $1 trillion on infrastructure. In response, Senate Republicans proposed a $928 billion counteroffer to President Biden, in hopes to strike a bipartisan deal. On May 28, President Joe Biden proposed his $6 trillion budget to Congress, with higher taxes and spending on healthcare, education, and renewable energy. Democrats and the GOP continue to negotiate a bipartisan infrastructure plan.

In its third Financial Stability Review since the COVID-19 pandemic, the European Central Bank (the “ECB”) warned that additional stimulus could be required as financial risks are elevated and uneven across the region. The recent surge in US government bond yields prompted the ECB to increase government bond purchases. On May 21, ECB President Christine Lagarde said “it’s far too early and it’s actually unnecessary to debate longer-term issues,” signaling no major policy change ahead of the June meeting.

President Joe Biden’s $6 trillion budget plan

President Biden’s budget proposal for 2022 reflects plans to spend on infrastructure and social programs in the next decade, which entail federal debt and deficits.

The budget includes $1.53 trillion for the military and domestic programs starting in fiscal 2022 (which begins in October) and proposes $4.5 trillion for infrastructure and social programs over the next decade. This includes $17 billion for repairing and improving roads, bridges, and airports, $4.5 billion for replacing lead water pipes, and $13 billion to expand high-speed broadband.

The proposal raises the corporate tax rate from 21% to 28% and the top capital-gains rate from 23.8% to 43.4%.

Other spending proposals include $132 billion for the Department of Health and Human Services, more than $36 billion in investments to tackle climate change, and a 41% increase in spending on the Department of Education.

The proposal is likely to be altered before approval by Congress, but it can be passed through the reconciliation process as Democrats control the House and the Senate, as was the $1.9 trillion COVID-19 relief plan in March.

Macro Indicators

Labor market recovery slows

The US labor market recovery slowed in April 2021. Unemployment edged to 6.1% in April from 6.0% in March, partially reflecting a rise in labor-force participation to its highest since August. Non-farm payrolls rose by 266,000 in April vs the Dow Jones estimates of 1 million new jobs, marking the weakest monthly growth since January 2021 amid a growing shortage of labor supply as employers struggle to find workers or remain cautious about hiring given the continued uncertainty caused by the pandemic. Weekly initial unemployment benefit claims fell by 38,000 in the week ending May 22 to 406,000, the lowest level since it hit 256,000 in March 2020. March 2021 euro area unemployment dropped to 8.1% from 8.2% in February but was still above the 7.3% in March 2020.

Vaccine and stimulus boost growth forecasts

The economic growth outlook continues to be positive. The estimate of annualized US GDP growth in Q1 2021 remains at 6.4%. Consumer spending continued to surge into Q2 2021, rising 0.5% in April driven by the widespread vaccine rollout, government stimulus, easing of business restrictions, and record personal savings.

US retail sales were unchanged in April, after jumping a revised 10.7% in March, as the effects of the stimulus payments fade.

Existing U.S. home sales fell 2.7% in April from March, marking third consecutive month of declines, to a seasonally adjusted annual rate of 5.85 million. Record-low supply amid strong demand for housing continues to push prices to near record highs.

The European Commission increased the eurozone growth forecast to 4.3% from 3.8% in 2021 and 4.4% in 2022 following an improved vaccination rollout, easing of restrictions, and expectation of additional fiscal stimulus.

The Consumer Price Index (CPI) increased 4.2% year on year (YoY) in April, the highest since September 2008, and a seasonally adjusted 0.8% month on month. Core CPI, which excludes food and energy, climbed 3.0% YoY and 0.9% from March, partly due to very low inflation during the same period last year during widespread economic shutdowns. CPI in the euro area increased 1.6% YoY in April, the highest since April 2019, while core inflation fell to 0.7% from 0.9% in March.

The IHS Markit US Manufacturing Purchasing Managers’ Index (“PMI”) rose to 62.1 in May from 60.5 in April. The IHS Markit Euro Area Manufacturing PMI rose to 63.1 in May from 62.9 in April.

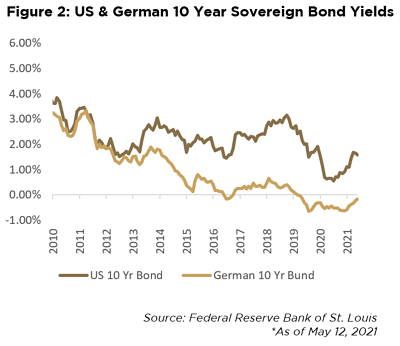

Sovereign bonds yields anticipate inflation

On May 11, 10-year US Treasury yields peaked at 1.70%, the highest since April 13, before ending the month at 1.58%. US inflation accelerated at its fastest pace since September 2008, as measured by CPI. Fed officials continue to reassure that inflation is transitory. 10-year inflation expectations, measured by Treasury Inflation Protected Securities, peaked to 2.54% in May, the highest since March 2013. Germany’s 10-year bund yields closed at -0.17%, its least negative yield since May 2019, and rose as high as -0.10% earlier this month. German government bonds are the only negative yielding 10-year government bonds in the eurozone.

Financial Markets

Equity markets shake off fears of rising rates

US equity markets rose in May in a volatile month dominated by rising inflation fears, a surge in consumer spending, continued vaccination, and growing optimism for economic recovery. The S&P 500 gained 0.6% in a fourth consecutive month of gains. The Dow rose 1.9% in May following a jump in Salesforce shares when its Q1 earnings beat expectations, while the Nasdaq declined 1.5%, breaking a seven-month streak of gains.

European equity markets also rose in May despite concerns over rising inflation, with the STOXX Europe 600 and the UK FTSE100 rising 2.6% and 0.8%, respectively, amid an improving economic outlook with rising vaccine distribution and easing restrictions. In Asia, the Hong Kong Hang Seng index, the Chinese SSE Composite Index and the Japanese Nikkei 225 Index rose 1.5%, 4.9% and 0.1%, respectively. Asian equities fell at month-end after Japan and China reported weaker-than-expected economic data. China manufacturing PMI was 51.0 (estimate was 51.1) while Japan retail sales grew 12% (estimate was 15.3%).

Credit spreads continue tightening

Investment grade spreads tightened to 0.91% while high-yield spreads widened to 3.34% from 3.28%. First-lien and second-lien spreads to maturity contracted to LIBOR + 3.72% from LIBOR + 3.84% and LIBOR + 6.82% from LIBOR + 7.11%, respectively. The yield-to-maturity of first- and second-lien debt remains below year-end 2019 levels due to near-zero interest rates and unprecedented Fed support for the fixed income market.

Oil rallies to pre-pandemic levels

Spot WTI and Brent crude oil prices increased from $63.58 and $66.76 per barrel, respectively, in April to $66.32 and $69.32 at the end of May, amid rising energy demand, promising economic data, strong earnings, and higher economic forecasts.

Sustained oil demand recovery depends on the pandemic situation. OPEC Plus is expected to keep its agreement to increase production by more than 2 million barrels a day. On April 27, OPEC Plus decided to raise oil production gradually by 350,000 barrels in May and June and 441,000 in July. Goldman Sachs predicts Brent to rise to $75 in Q2 2021 and $80 by Q3.

US dollar declines, gold rises, and Bitcoin falls

After a strong start to 2021, the US dollar continued its decline from April through May after the Fed kept interest rates near zero. The ICE US Dollar Index reached a four-month low of 89.6 against a basket of currencies on May 25, before edging higher to 90.0 at month end. Meanwhile, gold rose 7.8% in May to $1,905 per ounce at month end, exceeding $1,900 for the first time since November 2020. Gold prices should stabilize as inflation expectations subside. Bitcoin dropped 36% from $57,829 at the beginning of the month to a low of $30,000, the largest fall since November 2018, following efforts to tighten regulations and tax compliance on cryptocurrencies by Chinese and US authorities. Tesla CEO Elon Musk announced that the company will stop accepting payments in Bitcoin. Bitcoin closed at $36,731 at month end.

Sentiment

Consumer sentiment rises, market fear subdued

The Consumer Sentiment Index of the University of Michigan fell to 82.9 in May from 88.3 in April as consumers worry about rising inflation while the effects of government stimulus payments subsided.

The VIX index surged to 28 in May amid inflation concerns before subsiding to 16.76 at month end.

The month-end Fear and Greed Index (which uses seven factors including market momentum, safe-haven demand, and junk bond demand) showed “fear” at 40. Safe haven demand and stock prices show fear as investors flee risky stocks for the safety of bonds.

COVID-19

As of May 31, 2021, global confirmed cases of COVID-19 were 170,426,245, with 3,548,628 deaths and 1,579,416,705 administered vaccine doses. Since the rollout of COVID-19 vaccines in late 2020, the number of daily new cases dropped significantly in January and February 2021, especially in countries with effective vaccine campaigns. COVID-19 recovery remains uneven and slower than anticipated. Vaccine distribution to a significant portion of the population remains a challenge for most countries. The US is still the worst-affected country by overall case numbers, followed by India and Brazil.

According to Johns Hopkins University, the average daily COVID-19 cases in the US dropped more than 50% since the start of May. With average daily vaccinations of 1.7 million, almost half the US population had at least one dose by May 27.

During the last week of May, Europe had the largest decline in new COVID-19 cases and deaths, as some 44% of adults in the European Union received at least one dose, according to the World Health Organization and the Center for Disease Control. The U.K. was lifting its lockdown gradually as almost 60% of the population received at least one dose of the vaccine by May 30.

India was the second worst-affected country by cases after the US. In April, the number of daily cases and deaths in India started rising sharply to a record 400,000 in early May. Hospitals and crematoriums reached full capacity with a shortage of oxygen beds and drugs. Daily cases have since eased but remain above 100,000. Only 4.7% of the population has been fully vaccinated.

The Month Ahead

1. Global vaccine rollout

2. President Biden’s $6 trillion budget proposal

3. Fiscal stimulus in the US and Europe

4. Central bank reactions to rising yields

Disclaimer

This presentation is provided to you by The Family Office Co. BSC(c) (“The Family Office”) for informational purposes only, and contains proprietary information that may not be reproduced, distributed to, or used by, any third parties without The Family Office’s prior written consent.

All information, figures, calculations, graphs and other numerical representations appearing in this presentation have not been audited and may be subject to change over time. Furthermore, certain valuations (including valuations of investments) appearing in this presentation are subject to change as they may be based on either estimates or historical figures that do not reflect the latest valuation. Although all information and opinions expressed in this presentation were obtained from sources believed to be reliable and in good faith, no representation or warranty, express or implied, is made as to their accuracy or completeness. The information contained herein is not a substitute for a thorough due diligence investigation. Past performance is not indicative of and does not guarantee future performance. Exit timelines, prices and related projections are estimates only, and exits could happen sooner or later than expected, or at a higher or lower valuation than expected, and are conditional, among other things, on certain assumptions and future performance relating to the financial and operational health of each business and macroeconomic conditions.

The Family Office makes no representation or warranty, express or implied, with respect to any statistics or historical or current financial data, whether created by The Family Office through its own research or quoted from other sources. With respect to any such statistics or data delivered or made available by or on behalf of The Family Office, it is acknowledged that (a) the investor takes full responsibility for making its own evaluation of the materiality of the information and the integrity of the quoted source and (b) the investor has no claim against The Family Office.

Amounts in currencies other than the US Dollar are translated using prevailing market rates as calculated by The Family Office or its service providers and may differ from the rates used by banks. The rates are indicative only and do not reflect the rates at which The Family Office would be prepared to enter into any transactions with other parties.

Certain information contained in this presentation constitutes “forward-looking statements,” which can be identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “plans,” “estimates,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. To the extent this presentation contains any forecasts, projections, goals, plans and other forward-looking statements, such forward-looking statements are inherently subject to, known and unknown, significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond The Family Office’s control and may cause actual performance, financial results and other projections in the future to differ materially from any projections of future performance, results or achievements expressed or implied by such forward-looking statements. Investors should not place undue reliance on these forward-looking statements. The Family Office undertakes no obligation to update any forward-looking statements to conform to actual results or changes in The Family Office’s expectations, unless required by applicable law.

The Family Office makes no representation or warranty, express or implied, with respect to any financial projection or forecast. With respect to any such projection or forecast delivered or made available by or on behalf of The Family office, it is acknowledged that (a) there are uncertainties inherent in attempting to make such projections and forecasts, (b) the investor is familiar with such uncertainties, (c) the investor takes full responsibility for making its own evaluation of the adequacy and accuracy of all such projections and forecasts so furnished to it and (d) the investor has no claim against The Family Office.

This presentation represents a summary of certain information, the full terms of which are contained in a Private Placement Memorandum that should be reviewed for a more complete understanding of the investments and their risks. In addition, this presentation does not constitute an offer to sell, or a solicitation to buy, any instrument or other financial product, nor does it amount to a commitment by The Family Office to make such an offer at present or an indication of The Family Office’s willingness to make such an offer in the future.

The Family Office is a Category 1 Investment Firm regulated by the Central Bank of Bahrain C.R.No.53871 dated 21/6/2004. Paid Up Capital: US$ 10,000,000. The Family Office only offers products and services to ‘accredited investors’ as defined by the Central Bank of Bahrain.

Instagram

Instagram